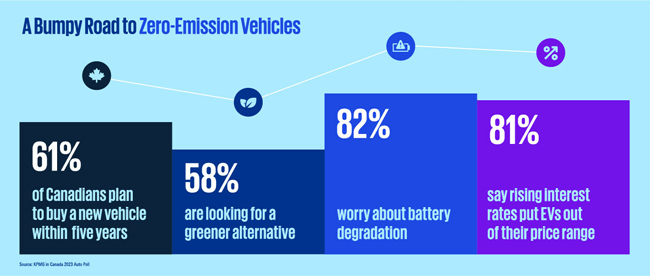

As many as six in 10 Canadians will buy a new vehicle within the next five years and would prefer a greener alternative to carbon-emitting gasoline-powered vehicles. But most will end up settling for a gas-powered one instead of electric due to higher financing costs, delays in delivery, and concerns over battery range and charging reliability, finds new KPMG in Canada poll research.

“It’s not that EVs have lost their appeal but rather that lack of inventory and long waiting lists over the past couple of years are giving consumers reasons to pause,” said Damiano Peluso, partner and national automotive industry leader, KPMG in Canada. “And now with expectations of a recession and sharply higher financing rates, our poll research shows consumer sentiment has shifted to pragmatism over ‘the machine of a dream’. As more EV models come to market this year and next, we will see sales pick up but a lot hinges on the price point and how well these persistent.”

Automakers may need to rethink their footprints and supply chains. Canadians are price sensitive, and while they crave range, they also say the only way to make EVs accessible to everyone is to go small, the KPMG poll showed. Yet only 55 per cent would buy a small EV (with limited range) if the country had a ubiquitous fast-charging infrastructure and 80 per cent say they won’t consider an EV without a 400-kilometre range.

There is also opportunity for automakers and auto dealers to pick up market share. Almost half of market is open to change, the poll shows. Only 54 per cent of respondents intend to buy a ZEV that’s the same brand as their current make. With many new EV models set to debut this year, the top three brands that prospective Canadian EV buyers say they’re most likely to purchase now are: Toyota, Honda, and, dropping from top spot last year to third, Tesla.

Over two-thirds (67 per cent) would prefer to buy an EV assembled in North America and half (51 per cent) are concerned the transition to EV manufacturing will result in more job losses in the Canadian auto industry. According to KPMG International’s 23rd Annual Global Automotive Executive Survey, over 910 executives around the world have tempered worldwide EV sales forecasts and are concerned about supplies of commodities and components. They also believe consumer buying decisions in the next five years will focus on the importance of driving performance and brand image.

“While our survey shows that most Canadians want to buy an EV that’s made in North America, important decisions are still being made on battery, assembly, and parts manufacturing locations,” said Tammy Brown, partner and national leader, Industrial Markets, KPMG in Canada. “As a result, the domestic market may not be able to meet the federal zero-emission vehicle targets, which may force Canadians to buy a greater share of imported electric vehicles. The global auto industry took nearly 13 decades to perfect the internal combustion engine and are now trying to meet consumer and regulatory expectations for electric vehicles in just two decades. We’re optimistic it can be done, with Canada playing a key role given our robust auto manufacturing and innovation ecosystem and proximity to key U.S. markets. The challenge is, it’s an entirely new industry dependent on commodities that have yet to be mined in Canada and components that can, as we’ve seen, become scarce.”