Elon Musk bought over $1 billion worth of Tesla’s stock, sending the share price soaring. The move comes amid highly suspicious option transactions on Tesla’s stock.

Today, Tesla disclosed in an SEC filing that Elon Musk bought Tesla stock for the first time in 5 years.

He purchased 2.5 million shares worth roughly $1 billion on Friday, which explained why the stock surged 7% that day on no news.

Tesla insiders have been consistently selling Tesla stock for the past decade, with virtually no one buying anything other than Joe Gebbia, a friend of Musk known as the co-founder of Airbnb and a board member at Tesla, who bought $1 million worth of stocks.

The last time Musk himself traded the stock was to sell tens of billions worth to finance his acquisition of Twitter.

Now, buying the stock is seen as a positive reversal of the insider trading trend.

However, it comes at a highly suspicious moment.

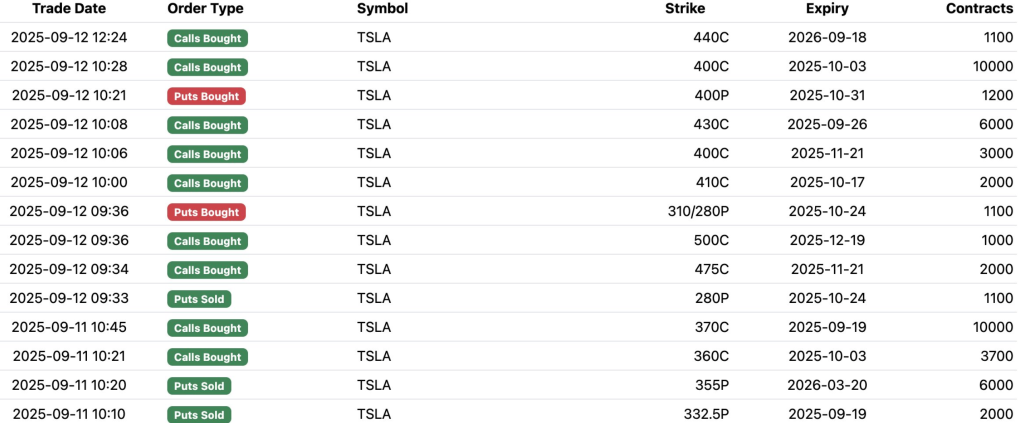

On Friday, when Musk was boosting Tesla’s stock price with 25 stock purchases worth more than $1 billion, some people were making some suspicious bets that the stock would surge in the short term without any known catalyst.

The stock option market on Tesla’s stock was wild on Friday. Some people made some wild bets like buying thousands of call contracts at a strike pirce of $430 with an expiry date within two weeks:

You will sometimes see this type of short-term expiry contracts ahead of earnings when large stock price swings are likely in one direction or the other. However, Tesla has no earnings or catalysts of any type coming in the next two weeks.

These contracts have surged in value by 1,000% following the revelation of Musk’s stock purchase.

Electrek’s Take

People bet millions on this short-term swing in Tesla stock. To be clear, this doesn’t necessarily represent a strong conviction in Tesla’s stock increasing in value; it is a bet on a very short-term swing up.

They were either extremely lucky that Musk decided to time his stock purchase this way, or they knew he was buying because he had told them.

With the SEC being virtually absent for the past year and allowing rampant fraud in the market, I wouldn’t be surprised if some shenanigans were going on here.

FTC: We use income earning auto affiliate links. More.